richmond property tax calculator

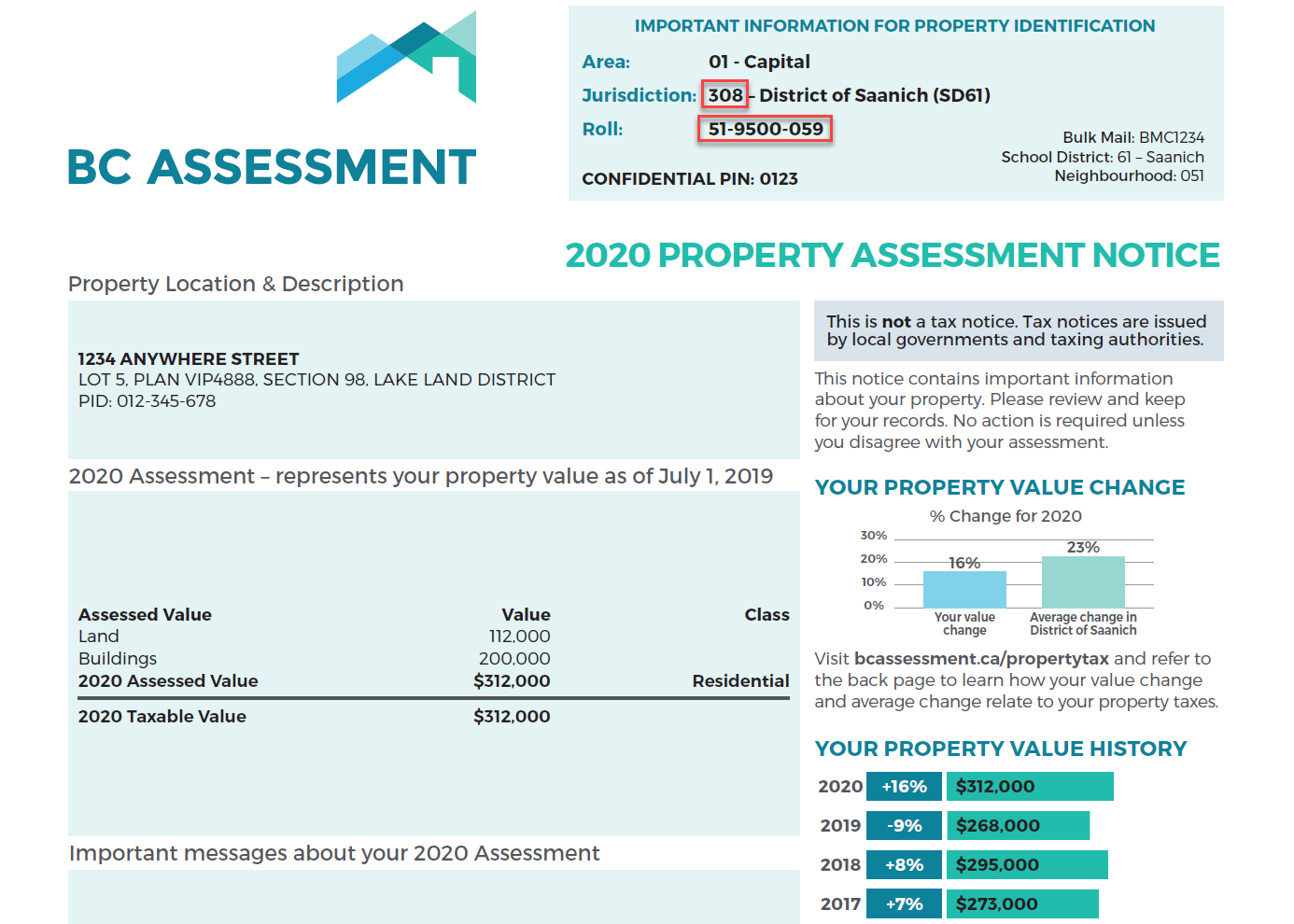

Richmond Hill real estate prices have increased by 15 from November 2019 to November 2020 and the average price. Municipal Finance Authority 250-383-1181 Victoria Property Assessments.

Average Residential Tax Bill Amount

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County.

. For all who owned property on January 1 even if the property has been sold a tax bill will still be. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes.

City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Learn all about Richmond real estate tax.

Richmond Property Tax Calculator 2021. Richmond Hill Property Tax 2021 Calculator u0026 Rates. The City Assessor determines the FMV of over 70000 real property parcels each year.

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which. Restaurants In St Cloud Mn Open For Thanksgiving. The median property tax on a 9930000 house is 104265 in the United States.

Please note that we can only. Pay Your Parking Violation. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Under the state Code reexaminations must occur at least once within a three-year timeframe. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Actual property tax assessments depend on a number of variables. Parking tickets can now be paid online. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being.

To pay your 2019 or newer property taxes online visit. A 10 yearly tax hike is the maximum raise allowed on the capped properties. Website Design by Granicus - Connecting People and Government.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County. The average effective property tax rate in. The citys average effective property tax rate is 111 among the 20 highest in Virginia.

Property taxes are calculated based on the assessment values set by. Richmond Property Tax Calculator. Richmond property tax calculator.

These documents are provided in Adobe Acrobat PDF format for printing. Italian Restaurant Detroit Lakes Mn. August 7 2021 adnecasino No comments.

Click Here to Pay. The population of Richmond Hill increased by 5 from 2011 to 2016. Property Tax Calculator Toronto.

It is one of the most populous cities in Virginia. Parking Violations Online Payment. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Item 2016 2017 2018 2019 2020. Calculate your property taxes due in Richmond Hill. Richmond Property Tax Calculator.

Call 804 646-7000 or send an email to the Department of Finance. Opry Mills Breakfast Restaurants. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access.

The City of Richmond is located south of Vancouver in the Metro Vancouver Regional District and is home to over 198K residents. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Restaurants In Matthews Nc That Deliver.

Richmond real estate prices have not changed significantly from November 2019 to November 2020 and the average price of a house in Richmond is 972K.

If You Could Do Anything With This Open Lot What Would You Do Kim Shaw Do Anything Open House Property Tax

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

Where Do I Find My Folio Number And Access Code Myrichmond Help

Oakville Property Tax 2021 Calculator Rates Wowa Ca

Ontario Property Tax Rates Lowest And Highest Cities

Property Assessment Assessment Search Service Frequently Asked Questions

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Rental Cash Flow Analysis Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

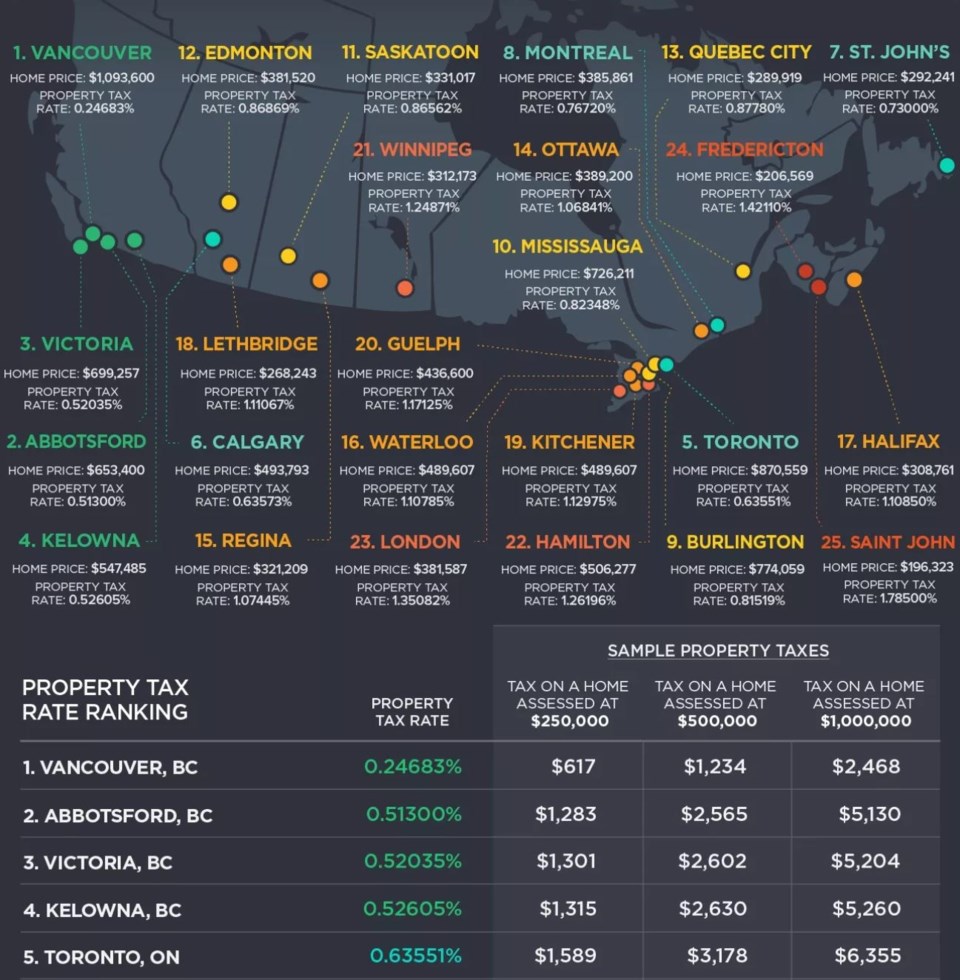

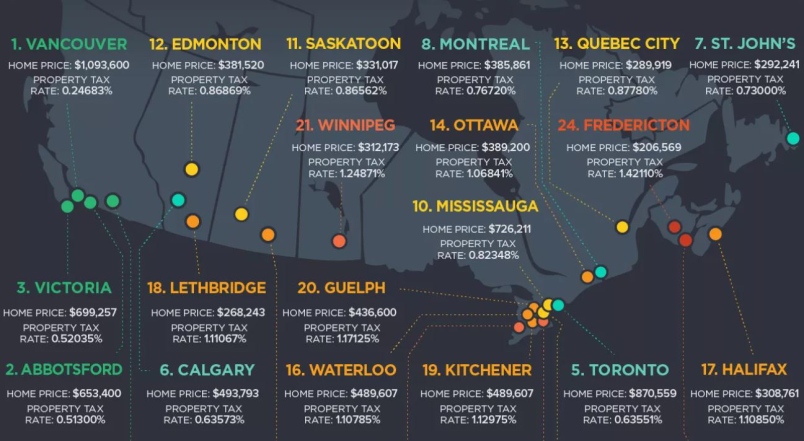

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Pin On Personal Financial Budgeting

Lower Mainland 2022 Property Assessments In The Mail